Meaning Of Buy Limit In Forex

Types of Orders

The MetaTrader 5 mobile platform allows users to prepare and issue requests for the banker to execute trading operations. In add-on, the platform allows to control and manage open positions. For this purposes, several types of trade orders are used. An order is an instruction of a brokerage firm's client to conduct a trade operation. In the terminal, orders are divided into two main types: market and pending. Also them there are "Cease Loss" and "Take Turn a profit" orders.

Market Orders #

A market order is an instruction given to a brokerage company to buy or sell a financial instrument. Execution of this society results in committing a bargain. The price at which the deal is conducted is adamant by the type of execution that depends on the symbol type. Generally, a security is bought at the Ask cost and sold at the Bid price.

Pending Orders #

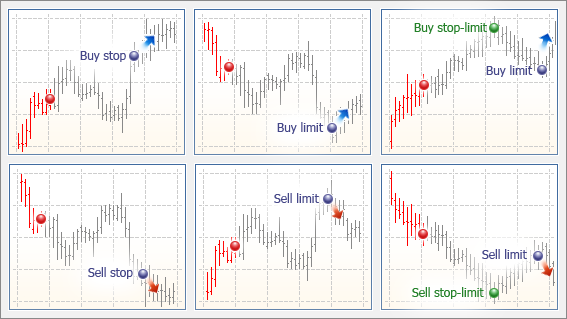

A pending order is the trader's didactics to a brokerage company to buy or sell a security in future under pre-defined weather condition. Types of pending orders:

- Purchase Limit – a trade asking to buy at the Ask toll that is equal to or less than that specified in the gild. The current price level is higher than the value in the order. Usually this lodge is placed in anticipation of that the security price, having fallen to a certain level, will increment.

- Buy Stop – a trade lodge to buy at the "Ask" price equal to or greater than the one specified in the order. The current toll level is lower than the value in the order. Unremarkably this order is placed in anticipation of that the security price, having reached a sure level, will proceed on increasing.

- Sell Limit – a trade order to sell at the "Bid" cost equal to or greater than the 1 specified in the order. The electric current price level is lower than the value in the gild. Normally this lodge is placed in anticipation of that the security price, having increased to a certain level, will fall.

- Sell End – a trade order to sell at the "Bid" price equal to or less than the i specified in the order. The current cost level is college than the value in the club. Usually this order is placed in anticipation of that the security price, having reached a certain level, will keep on falling.

- Purchase Stop Limit – this type combines the two beginning types being a cease lodge for placing Buy Limit. Every bit soon as the future Ask price reaches the terminate-level indicated in the order (the Toll field), a Purchase Limit order will exist placed at the level, specified in Stop Limit price field. A stop level is gear up to a higher place the current Enquire toll, while Terminate Limit price is ready below the stop level.

- Sell Stop Limit – this type is a stop order for placing Sell Limit. As soon every bit the future Bid price reaches the cease-level indicated in the order (the Price field), a Sell Limit order will be placed at the level, specified in Stop Limit toll field. A cease level is prepare below the current Bid toll, while Stop Limit price is ready in a higher place the stop level.

- For symbols with Substitution Stocks, Exchange Futures and Futures Forts calculation modes, all the types of pending orders trigger according to the Last price (cost of a last executed deal). In other words, an order triggers when the Last price touches the cost specified in the order. But notation that buying or selling as a issue of triggering of an order is always performed by the Bid and Ask prices.

- In the Exchange execution mode, the cost specified when placing limit orders is not verified. It can be specified in a higher place the current Inquire price (for the Purchase Limit orders) and below the electric current Bid price (for the Sell Limit orders). When placing an order with such a price, it triggers almost immediately and turns into a marketplace 1. However, different market orders where a trader agrees to perform a deal by a non-specified current market price, a pending guild will exist executed at a price no worse than the i specified.

- If an advisable market operation cannot be executed when a pending order triggers (e.g. there is not plenty margin), the awaiting order is canceled and moved to history with the Rejected condition.

| | – Current market place state | | – Forecast |

| | – Current cost | | – order toll |

| | – the toll, reaching which the awaiting club will be placed | ||

| | – Expected growth | | – expected fall |

Take Profit #

The Take Profit order is intended for gaining the profit when the security price has reached a sure level. Execution of this social club leads to a complete closure of the position. It is always continued to an open up position or a awaiting lodge. The social club can be placed merely together with a marketplace or a pending guild. This gild condition for long positions is checked using the Bid price (the social club is always prepare above the current Bid price), and the Inquire price is used for brusque positions (the order is ever set up below the current Inquire price).

Cease Loss #

This order is used for minimizing of losses if the security price has started to motility in an unprofitable direction. If the toll of the instrument reaches this level, the position is fully closed automatically. Such orders are always associated with an open up position or a pending order. The lodge can exist placed only together with a market place or a pending lodge. This order condition for long positions is checked using the Bid price (the society is always set below the current Bid toll), and the Enquire price is used for short positions (the order is always set above the current Ask price).

- Take Profit and Stop Loss levels are placed for a position according to its latest lodge (market or triggered pending society). In other words, in every new order of the aforementioned position stop levels supervene upon previous ones.

- Triggering of Accept Profit and End Loss leads to a complete closure of a position.

- For symbols with Exchange Stocks, Exchange Futures and Futures Forts calculation modes, Cease Loss and Take Profit orders trigger according to the Concluding price (price of a last executed deal). In other words, a stop-society triggers when the Terminal price touches the specified price. Simply note that buying or selling as a result of triggering of a terminate-order is always performed by the Bid and Enquire prices.

- If during Have Turn a profit or Finish Loss activation the corresponding marketplace operation cannot be executed (for example, it is rejected by the exchange), the order will not be deleted. It volition trigger once again at the next tick corresponding to the order activation conditions.

Stop Loss and Take Turn a profit inheritance rules (netting): #

- When increasing position volume or reverting the position, Take Profit and Finish Loss levels are placed according to its latest gild (marketplace or triggered awaiting order). In other words, in every new order of the aforementioned position stop levels replace previous ones. If zippo values are specified in the order, End Loss and Take Profit of a position will be deleted.

- If a position is partially closed, Stop Loss and Take Profit are non changed by the new order.

- If a position is fully closed, the Finish Loss and Have Profit levels are deleted, because they are associated with an open position and cannot exist without it.

- If a trade operation is executed for a symbol, for which at that place is a position, the current Stop Loss and Take Profit of the open position are automatically inserted in the order placing window. This is aimed to preclude adventitious deletion of electric current stop orders.

- During one click trading performance executed from the Market Depth for the symbol, for which in that location is a position, the current values of Stop Loss and Accept Profit are not changed.

- On the OTC markets (Forex, Futures), when a position is moved to the next trading day (the bandy), including through re-opening, the levels of Stop Loss and Take Turn a profit are remain unchanged.

- On the commutation marketplace, when a position is moved to the next trading day (the swap), every bit well equally when moved to another business relationship or during delivery, the levels of Cease Loss and Accept Profit are reset.

Terminate Loss and Take Turn a profit inheritance rules (hedging):

- If a position is partially airtight, Stop Loss and Take Turn a profit are not changed by the new guild.

- If a position is fully closed, the End Loss and Take Profit levels are deleted, because they are associated with an open position and cannot exist without it.

- During one click trading operation executed from the Depth of Market, the Stop Loss and Have Profit levels are not set.

Meaning Of Buy Limit In Forex,

Source: https://www.metatrader5.com/en/mobile-trading/iphone/help/trade/general_concept/order_types

Posted by: hughesthomed.blogspot.com

0 Response to "Meaning Of Buy Limit In Forex"

Post a Comment