Forex Brokers With Automatic Withdrawal

List of the best 20 Forex Brokers | Trusted reviews and comparing

Are you looking for a good and serious forex broker? – Then this folio is the right place for y'all. Thanks to the large selection on the Internet it is often difficult to make the correct conclusion. With more than 9 years of feel in the fiscal markets, we present y'all with the all-time providers with top service and without subconscious costs. Find out in the following texts how to select a secure forex provider and which online broker offers the all-time conditions.

Trading with a forex broker

See the comparison in the table below:

| Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open Account: |

|---|---|---|---|---|---|---|

| 1. BDSwiss | | CySEC, FSC | Starting 0.0 pips + $ 5.0 commission per 1 lot traded | ten,000+ | + Private offers | Live-account from $100 (Risk Alarm: Your capital can exist at risk) |

| 2. RoboForex | | IFSC | Starting 0.0 pips + $ iv.0 commission per i lot traded | 9,000+ | + Huge diversity | Live-account from $10 (Chance Warning: Your capital tin exist at adventure) |

| 3. Etoro | | CySEC, FCA, ASIC | Starting i.0 pips variable (no commission) | 3,000+ | + Best for beginners | Live-business relationship from $200 (Risk Alarm: 76% of accounts lose money) |

| 4. IQ Pick | | CySEC | Starting 0.0 pips variable (no committee) | 500+ | + Piece of cake to use | Live-business relationship from $x (Run a risk Waring:84% of accounts lose money) |

| v. BlackBull Markets | | FSPR, FSCL | Starting 0.0 pips + negotiable commission per 1 lot | 100+ | + ECN Broker | Alive-account from $200 (Adventure alert: Your majuscule can exist at risk) |

| 6. XM Forex | | IFSC, CySEC, ASIC | Starting 0.0 pips + $ three.v commission per 1 lot | i,000+ | + Huge variety | Alive-account from $5 (Risk Warning: 78.04% of accounts lose money) |

| 7. Tickmill | | FCA, CySEC, FSA | Starting 0.0 pips + $ 2.0 committee per 1 lot | 100+ | + VIP conditions | Alive-business relationship from $100 (Hazard Warning: Your upper-case letter can be at take a chance) |

| eight. OctaFX | | CySEC | Starting 0.3 pips – No commissions | 100+ | + Support 24/7 | Live-account from $100 (Adventure Warning: Your capital is at risk) |

| 9. IC Markets | | ASIC, CySEC, FSA | Starting 0.0 pips + $ 3.0 commission per 1 lot | 232+ | + Good conditions | Live-account from $200 (Risk Alarm: Your capital can be at risk) |

| ten. FXCM | | FCA, AFSL, FSCA | Starting 0.ii pips variable | 200+ | + NDD/ECN Banker | Live-account from $fifty (Take a chance Alert: 74 – 89% of accounts lose money) |

| 11. FxPro | | FCA, CySEC, FSCA, DFSA, SCB | Starting 0.0 pips variable | 250+ | + High liquidity | Alive-account from $100 (Risk Alarm: 76.14% of accounts lose coin) |

| 12. XTB | | More than x | Starting 0.0 pips + 3.5$ commission per 1 lot | 3,000+ | + Huge diverseness | Live-account from $0 (Run a risk Warning: 77% of retail accounts lose money) |

| 13. Markets.com | | CySEC, FSCA, ASIC, FCA | From 0.six pips variable (no commission) | ii,200+ | + Easy to use | Live-business relationship from $100 (Risk Alarm: 72.one% of accounts lose money) |

| 14. Vantage FX | | ASIC, CIMA | Starting 0.0 pips + $ 2.0 commission per one lot | 120+ | + Leverage 1:500 | Alive-account from $200 (Adventure Alarm: Your uppercase can be at risk) |

| xv. Pepperstone | | FCA, ASIC | Starting 0.0 pips + $ 3.5 commission per 1 lot | 150+ | + Fast execution | Alive-account from $200 (Risk Alert: 74 – 89% of accounts lose coin) |

| 16. Deriv.com | | VFSC, FSC, FSA | Starting 1.0 pips variable | 100+ | + Merchandise with i$ | Live-account from $10 (Take chances Alarm: 71% of accounts lose coin) |

| 17. Admiral Markets | | FCA, ASIC, CySEC, EFSA | Starting 0.0 pips variable + $ 3.0 commission per 1 lot | 3,000+ | + Multi-regulated | Alive-account from $100 (Run a risk Alarm: 79% of accounts lose money) |

| 18. Libertex | | CySEC | 0.0 pips + 0,01% committee of the trading volume | 300+ | + Beginner-friendly | (Risk Warning: 83% of accounts lose money) |

| xix. InstaForex | | CySEC, BVI FSC | Starting 0.0 pips + 0.02% – 0.07% commission per 1 lot | 300+ | + Good conditions | Live-account from $ane (Run a risk Warning: Your capital can be at take a chance) |

| 20. AXI | | FCA, ASIC, DFSA | Starting 0.0 pips + three.5$ commission per 1 lot | 140+ | + Multi regulated | Live-account from $0 (Risk Warning: 76.4% of accounts lose coin) |

The following list of brokers we accept reviewed and which are the best for forex trading:

- BDSwiss – High leverage forex trading for everyone

- RoboForex – Gratis bonus and cashbacks

- Etoro – The best choice for beginners

- IQ Option – Showtime forex trading with only $1

- BlackBull Markets – Deep liquidity

- XM – Micro accounts are possible

- Tickmill – All-time trading atmospheric condition

- OctaFX – Crypto payments available

- IC Markets – 0.0 pips real spreads

- FXCM – Many platforms available

- FxPro – No requotes with no dealing desk

- XTB – Professional platform

- Markets.com – Big actor in the forex industry

- Vantage FX – High leverage

- Pepperstone – Fast execution and low spreads

- Deriv – Supports automated trading

- Admiral Markets – Overall good conditions

- Libertex – Trade without spread

- InstaForex – Bonus and contests

- AXI – Competitive banker

Our strict criteria for the forex banker reviews

In contrast to many other comparison sites, we present you on this website simply the safest providers with the best conditions for traders. As experts with many years of feel, nosotros have tested many forex brokers and still use some of them. A good provider should take certain characteristics that guarantee good and prophylactic investing.

Information technology is not uncommon to hear of fraud on the Internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the merchandise reduce of course the bodily profits. Also, the security of client's coin is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we tin can nowadays to you on this page the best forex brokers in a listing.

Proven facts for a good forex broker:

- Regulation and license of an official finance dominance

- High safety of customer funds

- Fast and reliable market place execution

- Small-scale Forex Trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional back up

- Fast eolith and withdrawal methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank marketplace for currencies (Wikipedia). In addition, the broker can lend capital letter to the trader then that he can trade with leverage. The broker'due south income is generated by the spread and the toll of financing the leveraged positions.

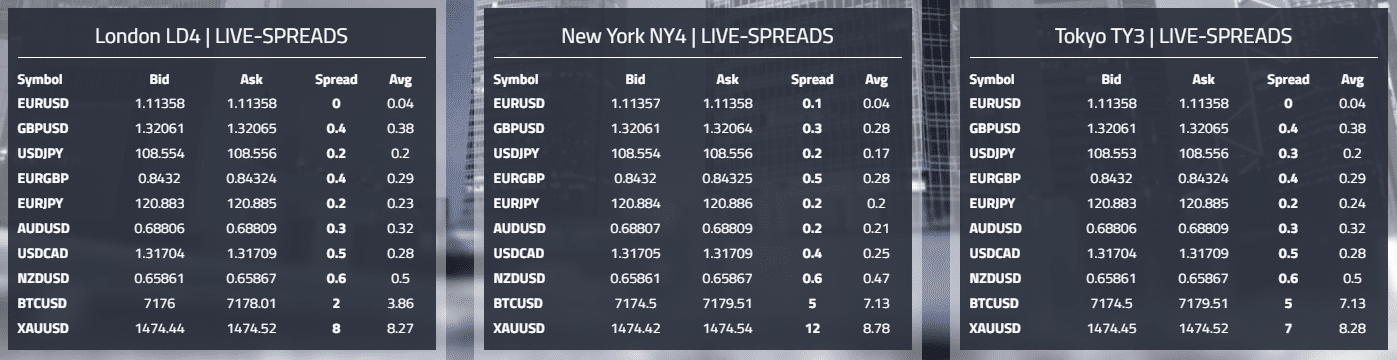

Example of alive spreads for Forex Brokers

Market maker:

This banker does non place the trader's orders directly into the real interbank or spot marketplace. There is an internal matching organization between the positions of the traders. Of course, the banker can hedge himself on the real markets and then that there are no distortions in supply and demand. In virtually cases, this system can be opaque, and only as a banker employee, you know the exact functions. A market maker forex banker is dandy or scam. Nowadays, most providers offer good and exact executions.

ECN broker:

ECN (Electronic Advice Network) ways directly admission to the interbank market through various liquidity providers and other traders. These are large banks or very large forex brokers. The provider places the trader'south orders straight into the real market. And then the customers get direct and real market prices for trading. With this model, there is no disharmonize of involvement betwixt trader and broker. Also, you lot will get the best trading conditions with these types of brokers. You can read our ECN forex banker comparison here.

No dealing desk-bound banker:

Most forex brokers accept no dealing desk. That ways there is no influence from the banker on the trader'due south orders. NDD brokerage is safe to utilise and there is too no conflict of interest. You will accept no requotes with a no dealing desk banker like with an ECN broker. Dealing desk brokers can manually influence the spreads and execution of traders. You can read our NDD broker comparing here.

STP broker:

STP stands for directly idea processing and is a well-known term in forex and CFD trading. It is similar to an ECN and NDD broker. STP ways you have no dealing desk and all orders are executed direct on the market or by liquidity providers. You lot can read our STP banker comparison hither.

Forex broker with loftier leverage:

Not all forex brokers are offering high leverage for currency trading. The regulators in Europe and Australia limit the leverage for retail clients to i:30. For getting higher leverage yous have to exist a professional trader. Most retail traders can not achieve this status because in that location are hard requirements for information technology. The solution to switch to a forex broker with another regulation authority that has no restrictions to loftier leverage trading. Y'all tin can read our comparing of forex brokers with high leverage here.

Forex broker with cent accounts:

The standard forex trading order size is adamant in lots. There are i.00 lot (standard), 0.10 lot (mini), and 0.01 lot (micro). ane lot ways 100,000 units of the base currency. At that place are opportunities to trade with a smaller society size like 0,01 lot. Information technology is called cent accounts. 0.01 lot means 1,000 units of the base currency. With a cent account, it means simply 100 units. Cent accounts are suitable for traders who desire to start with very small amounts of money. You can read our comparison of cent business relationship hither.

Forex banker with naught spreads:

Zilch spread accounts are offered by ECN or NDD brokers. That means you will become raw spreads from the markets. Depending on the broker it tin be really 0.0 pip spread. This type of trading accounts is suitable for scalp traders and traders who are using a high order book. Read our comparison of zero spread accounts here.

Warning: Only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When information technology comes to trading leveraged financial products, you have to be able to trust the forex broker. Information technology is not uncommon for large sums of money to be used to generate a large turn a profit. For case, brokers in Europe must have regulations or licenses if they desire to offering their services. The regulation can be in whatever European country. The aforementioned or almost the same requirements employ to brokers everywhere. In order to avoid fraud, it is of import to look for such a license.

Licenses are merely issued under certain atmospheric condition and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and guarantee a safe trade. Many brokers, for example, are regulated in Republic of cyprus. This has taxation advantages. Nonetheless, in that location are also forex brokers with more than than i regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated client funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important betoken for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on client funds themselves. In the cease, withdrawals were refused or delays occurred.

The most popular regulators are:

- ASIC – Australian Securities & Investments Commission

ASIC regulation for forex brokers

- FCA – Financial Comport Authority

FCA regulation for forex brokers

- CySEC – Cyprus Securities and Exchange Commission

CySEC regulation for forex brokers

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of coin in your account. Some brokers offer leverage up to ane:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could skid into the negative balance. This is possible due to farthermost market situations and too large a position size in relation to the business relationship residual.

The providers shown above all take no obligation to brand additional contributions (except IC Markets and Vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is as well heavily leveraged. Yous should ever beware of sensible risk management.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. Information technology is a virtual credit account that simulates real money trading. Information technology can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely gratuitous and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very heady. Information technology should piece of work smoothly and be highly secure. Forex Brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit carte, e-wallet, PayPal, crypto) or with the archetype mode of banking company transfer. Electronic methods piece of work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very depression. For example, you tin can open an business relationship for as little every bit one$. If this is worth information technology, you have to decide for yourself. In that location are no fees for deposits.

example of payment methods of a Forex Broker

The payout is also very simple. With a few clicks, y'all can request a withdrawal on the card. This is then released in 1-3 working days. Notwithstanding, almost brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees tin can be high for small-scale payouts. With payments over 200$, most forex brokers take over the fees just some brokers do not accuse any commissions.

Facts almost the payments:

- Instant deposit of coin

- Fast withdrawal within 1 – three working days

- Electronic Methods (Skrill, Neteller, PayPal, and more)

- Cryptocurrencies

- Bank wire

Not every country is bachelor for forex trading

Not every country is available for Forex Brokers and trading. This is because there are some restrictions and special regulations. For case, in some countries, an international broker needs a special license for that specific land. So information technology is too much to beget for some companies to get the license and they finish taking clients from these countries. You lot can clearly run into on the homepage which clients they accept. Not many brokers have clients of the United States of Amerika.

From my experience, the fastest-growing countries are in Africa and Asia. Because of the development of the mobile internet, more people get connected to the forex market. Bharat, Nigeria, the Philippines, Malaysia, and Mainland china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing coin into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review determination: Offset trading with a reliable Forex Banker

On this page, we have presented you with our electric current list of the top 20 Forex Brokers in comparison. Now you have a selection of good and reputable companies in front end of you. It was particularly important to us that we but present providers here, which we accept tested by ourselves with real money. This is not the example with most comparisons.

Profit now from the nigh favorable fees and the best atmospheric condition by my experience of many years. With these providers, y'all are 100% safe and can take your Forex trading to the side by side level.

We hope y'all could learn something in this comparison and act now with better providers through my recommendations. If yous can't make upwards your mind, please also read the reviews.

Find the correct forex broker in our other comparisons:

Source: https://www.trusted-broker-reviews.com/forex-broker/

Posted by: hughesthomed.blogspot.com

(5 / 5)

(5 / 5)

(four.ix / 5)

(four.ix / 5)

(4.8 / v)

(4.8 / v)

(iv.7 / v)

(iv.7 / v)

0 Response to "Forex Brokers With Automatic Withdrawal"

Post a Comment