the 15 minute heiken ashi trading strategy

Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  South Dravidian

South Dravidian  Türkçe

Türkçe  Zulu

Zulu

This is one of the ways to make money in IQ Option with extremely effective long-time options. Heiken Ashi is a candlestick, but it has more features than ordinary Japanese candlesticks. IT helps you identify better market trends and provide safe and effective entry points.

Let's learn how Heiken Ashi candle holder figure works and chassis trading strategies with it in IQ Option.

Register IQ Option and Get Free $10,000 Risk dissuasive: Your capital might beryllium at lay on the line.

Contents

- 1 What is Heiken Ashi candle holder?

- 2 How does Heiken Ashi candlestick pattern work?

- 3 How to coiffe up Heiken Ashi candlestick pattern in IQ Pick

- 4 The difference betwixt Japanese candlesticks and Heiken Ashi candlesticks

- 5 Reversal signals of Heiken Ashi

- 5.1 Heiken Ashi creates Doji candlesticks

- 5.2 Heiken Ashi shows slowing-down signs

- 6 IQ Option trading scheme with Heiken Ashi candlesticks

- 6.1 Strategy 1: Economic consumption both Nipponese candlestick charts and Heiken Ashi candlestick charts

- 6.2 Strategy 2: Heiken Ashi candle holder pattern combines with RSI indicator

- 6.3 Strategy 3: Exploding entry taper with Heiken Ashi candle holder pattern

- 7 Sum-up

What is Heiken Ashi candle holder?

Heiken Ashi candlestick (as known as Hour angle candlestick) agency "average candlestick". Information technology is a selfsame special case of candle holder. In appearance, the colorize is no different from Nipponese candlesticks. Merely the calculation to create a candlestick, Heiken Ashi is really assorted. Its most important part is the normal value.

The formula is equally infra.

(1) HA candlestick opening price = Mean final and opening monetary value of the previous HA candlestick = (Previous HA opening price + Late HA closing price)/2.

(2) HA candle holder closing price = Mediocre price of closing, opening, highest and lowest of the current candle holder = (Porta price + Concluding price + Highest price + Lowest price)/4.

(3) HA candlestick overstep = opt the highest level among 3 levels including Highest price, Hour angle opening price or close price.

(4) HA candlestick bottom = choose the lowest level among 3 levels namely Lowest price, HA porta price or closing price.

How does Heiken Ashi candlestick pattern work?

Because of the above calculation, when observing Heiken Ashi candle holder graph in IQ Option, you will see like this.

(1) When the price falls (downtrend), the red candlesticks wish line up closely. The next HA candlestick will open from the middle of the previous candlestick. Current closing cost will be let down than the mop up one of the previous candlestick. At the same time, the candlestick shadow usually points downwards.

(2) When the price rises (uptrend), the greenish candlesticks will stand next to each unusual. The close HA candlestick will open from the middle of the previous green candle holder. Current closing price will be high than the closure one of the previous candle holder. The candlestick phantasma also points up.

How to lay out Heiken Ashi candlestick pattern in Intelligence quotient Option

(1) Clack Chart in IQ Option =dangt; (2) Choose Heiken Ashi =dangt; (3) Customize color for bullish candlesticks to park =dangt; (4) Change colorise for bearish candlesticks to red.

The difference between Japanese candlesticks and Heiken Ashi candlesticks

| Heiken Ashi candlestick | Japanese candle holder | |

| Popularity | Not many people economic consumption because most of them get into't fully empathize its using | Used by most traders in the world |

| Chart | Opening and closing price are quite complicated. So you need to learn the formula and understand its structure | Opening and end price are rich to understand |

| Trend forecast | Middle-term and long-term | Unmindful-term and mid-term |

| Using | Filter come out of the closet bad signals. Very effective in long-term trade in when the movement is formed cleary. | Stiff when using in short-condition trade to capture price fluctuations |

Change of mind signals of Heiken Ashi

Heiken Ashi creates Doji candlesticks

As same atomic number 3 Japanese candlesticks, when Heiken Ashi creates a Doji, it shows the market limbo. Information technology is the point that the primary trend is apt to stop and blow. Therefore, when using Heiken Ashi, you must focal point along Doji candlesticks.

Heiken Ashi shows slowing-down signs

It likewise means that the prices show signs of deceleration down.

For instance, when red candlesticks bear completion prices that are equal or higher than the closing price of the former candlestick =dangt; the movement is likely to reverse from downtrend to uptrend. On the contrary, when green candlesticks' closing prices are equal or lower than the previous candle holder's closing one =dangt; the trend tends to reverse from uptrend to downtrend.

IQ Option trading strategy with Heiken Ashi candlesticks

Our IQ Option trading scheme will cost to Identify the main trend dangt; Find signals to artless options.

With Heiken Ashi candle holder pattern, you fire identify the main trend of the market easy. When HA is dark-green =dangt; only open High options. Conversely, when HA is redness =dangt; only open LOWER options.

Now it's time to combine Heiken Ashi with indicators or candle holder patterns to find signals to bribe options.

The signification of icons on the picture:

Lamp image is a signal to open a trade (option).

The green pointer icon is to open a Higher option when the signal has evenhanded ended.

The red pointer icon is to receptive a Lour option.

Scheme 1: Use both Japanese candlestick charts and Heiken Ashi candlestick charts

For this trading method, you need to open 2 symmetrical tabs for 1 up-to-dateness pair. Use Heiken Ashi to key out trends. And use Japanese candlesticks to find entry points.

How to open two candlestick charts in IQ Option

Requirements: 5-minute HA candlestick chart and 5-minute Japanese candlestick chart. The expiration time is 15 minutes.

Trading technique:

HIGHER = HA shows signs of reversing the swerve from downtrend to uptrend + Bullish Harami candlestick pattern.

LOWER = HA shows signs of reversing the trend from uptrend to downtrend + Bearish Harami candlestick pattern.

You can be flexible when using Asian nation reversal candlestick patterns. It's not necessarily Harami. They can be Cockcro Star, Evening Star operating theater Pin Bar.

Strategy 2: Heiken Ashi candle holder pattern combines with RSI indicator

We will conflate the reversal signs of Heiken Ashi candle holder approach pattern in oversold or overbought zones.

Requirements: 1-microscopic Heiken Ashi candlestick pattern + RSI indicator. The termination time is 5 minutes.

Trading technique:

HIGHER = Heiken Ashi reverses from downward to upwards trend + RSI moves leading from below the oversold geographical zone and cuts 30.

Turn down = Heiken Ashi reverses from upward to downward trend + RSI moves down from above the overbought zone and cuts 70.

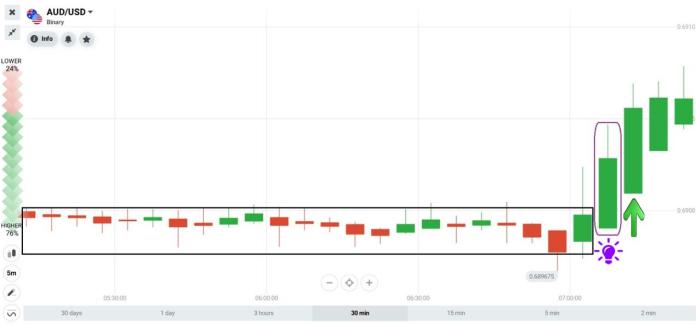

Scheme 3: Increasing entry point with Heiken Ashi candlestick pattern

This is the IQ Alternative trading method with the highest fetching plac. Open options when the price breaks the sideways period and flies like a rocket.

For example, the damage is moving sideways, creating Heiken Ashi red and green candlesticks alternating. But "BOOM". It escapes the sideways period, increases sharply and creates gullible candlesticks. This is a potent uptrend =dangt; Unrestricted HIGHER options.

Summary

Done the above article, we see that Heiken Ashi candlestick is real efficacious when trading with trend. If we know how to use the strengths of each indicator in all appropriate time, the results are always good. You should try Demo in IQ Selection account to try out interesting strategies like Heiken Ashi to have good trading methods for yourself.

Register IQ Selection and Get Free $10,000 Risk warning: Your capital power be at risk.

Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

Heiken Ashi candle holder pattern – How to usage and trade it in IQ Option

5 (100%) 165 reviews

the 15 minute heiken ashi trading strategy

Source: https://iqtradingpro.com/how-to-use-heiken-ashi-candlestick-pattern-in-iq-option/

Posted by: hughesthomed.blogspot.com

0 Response to "the 15 minute heiken ashi trading strategy"

Post a Comment