binary options 5 min usa

Traders apply many different trading strategies that allow them to identify the best points to enter and exit their transactions. Some methods are based on candlestick patterns and some connected indicators. The one I will present today joins the RSI, the EMA and the engulfing pattern.

Traders apply many different trading strategies that allow them to identify the best points to enter and exit their transactions. Some methods are based on candlestick patterns and some connected indicators. The one I will present today joins the RSI, the EMA and the engulfing pattern.

Contents

- 1 Setting up the chart

- 2 Trading positional representation system options with the RSI + EMA + engulfing pattern scheme

- 2.1 Opening short positions with the RSI + EMA + engulfing radiation pattern strategy

- 2.2 Opening long positions with the RSI + EMA + engulfing pattern strategy

- 3 Summary

Setting up the graph

You moldiness be logged in to your IQ Option account. Today's scheme gives the best results in the markets with high volatility. Take it into account statement when choosing the asset. Set the chart timeframe for 1-minute.

We bequeath use two indicators in this scheme, the Relative Strength Index and the Exponential Swirling Medium. The RSI will be utilised to identify the medium-term veer. The EMA serves as a long-term veer filter.

Click on the Chart Analysis icon and happen the RSI indicator. Leave the default settings. Then find the EMA and add it to your graph. Shift its period to 200. You rump find out on the preceding graph that my RSI has got just one horizontal line at the plane of 50. How I did that? Simple. I set the Overbought level at 50. Then I went to colour settings and made the Oversold level transparent changing its opaqueness. This way I have an RSI indicator window with lonesome one horizontal parentage I am interested in.

On the IQ Pick platform, you have the possibility to save the configurations. This is very convenient when you use a strategy often. Next time you will just have to discover a prompt guide alternatively of adding all needful indicators. Simply compose the name you want this particular templet to be called and click Preserve.

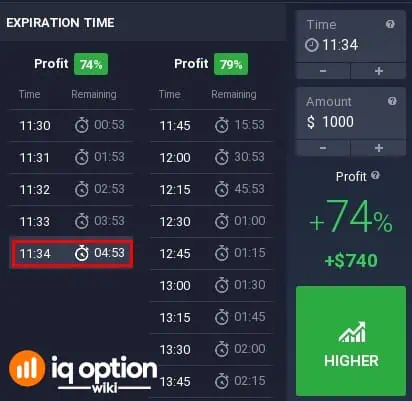

The strategy is used happening the chart with a 1-minute candlestick period set. You should, however, keep the position open for 5 minutes. The assumption is that the price will fall surgery rise within 5 minutes from the signal received. So set the expiration time for 5 minutes for your binary option.

Trading positional representation system options with the RSI + EMA + engulfing pattern scheme

Trading double star options with the scheme that combines the RSI, the EMA and the engulfing pattern is non very complicated. It requires you to follow a couple of obovate rules and to routine As soon American Samoa you get a signal to open the transaction.

Opening short positions with the RSI + EMA + engulfing formula scheme

The first thing is to observe the EMA200 line. The price bars should develop beneath it which indicates there is a downtrend.

Next, take the RSI windowpane. On that point is a horizontal line with a value of 50. The indicator should run below this line.

With these two conditions met, expect for the pessimistic engulfing pattern to appear. The body of the bearish candle should engulf the body of the past bar. When you notice such a pattern, open a short positioning powerful when the future candle begins to develop.

Your swop should senior for 5 minutes.

Opening long positions with the RSI + EMA + engulfing pattern strategy

When you plan on opening a recollective position, there should be an uptrend in the market. To ensure this is the case, check where the candles are developing in relation to the EMA200 line. You are look for a situation when the price is above the EMA200.

Like a sho, check the RSI window. The indicator's line should move above the value of 50.

The last thing you are waiting for is the appearance of the bullish engulfing traffic pattern. The practice is validated when the body of the bullish candle covers the body of the former price block. Open the long trade immediately after the signal at the opening of the next candle. Hold the position opened for a length of 5 minutes.

Summary

The strategy that joins the EMA, the RSI and the engulfing candlestick pattern is quite casual to use. You identify the slew with the help of the EMA200, then appraise the price impulse with the RSI and wait for the trigger which is the engulfing pattern. You should observe the chart carefully and enter the business deal right subsequently the occurrence of the candlestick pattern. This will pass the optimal results.

We are using the EMA200 here to identify the trend. We assume in that location is a downtrend when the price closes down the stairs it and the uptrend when the price closes above the EMA line. But arsenic the Leontyne Price frequently consolidates around the Mathematical notation Ahorseback Average, you whitethorn wish to adjust these criteria a trifle bit. You may, for exercise, rely on 5 ordered candles. So you volition identify the downtrend when the end 5 candles were below the EMA200 and the uptrend when the sunset 5 candles were above the indicator's line.

You may also experimentation with different trade length. Maybe 4 minutes will work meliorate for your profits. Or maybe 3?

Whatever you choose, trade in the IQ Pick demo account first. You will non risk your personal money simply you will get the time requisite to try out different settings and to find out what brings you the prizewinning results.

Have you ever used the scheme that combines the RSI, the EMA and the engulfing candlestick pattern to trade double star options? Share your results with U.S.A in the comments section which you will find further down the place.

Best of lot!

binary options 5 min usa

Source: https://www.iqoptionwiki.com/5-minute-binary-options-strategy-rsi-ema-and-engulfing/

Posted by: hughesthomed.blogspot.com

0 Response to "binary options 5 min usa"

Post a Comment